It is interesting to see how Torres was able to lure common investors to part with lakhs of rupees by carefully cultivating a larger-than-life image using social media within barely a year of launch.

Since its first week in Feb, Torres’s Instagram feed was filled with cashback promises, grand functions, and prizes like 2BHK flats, iPhones, and gold and silver jewellery. It’s also full of videos of new showroom inaugurations, fireworks and stage shows.

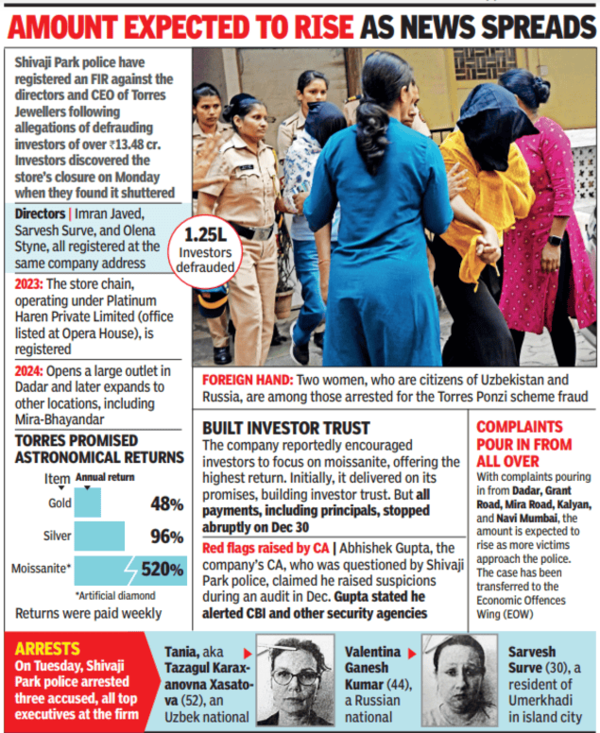

Coupled with the promise of astronomical returns on investment (see graphic), Torres’s social media profile seems to have sealed the bait.

Torres distributed weekly prizes. “It opened its sixth store in Kandivli with fanfare last month. A week ago, it gave exorbitantly expensive presents, including a flat. Five days ago, it announced another flat for its first anniversary (Feb 3). But the bubble burst,” said a businessman from Dadar. An Instagram post from Nov shows a woman receiving the keys to a sleek Toyota car at a glitzy event.

Torres’s optics were designed with utmost lavishness. Each event had professional emcees. Children were invited to pull lucky draw winners’ names in grand, well-lit showrooms. Giant logos and invitation cards were designed in white and gold, and elaborate floral arrangements added ambience.

Hundreds of smiling customers were shown raising cellphones to shoot selfies. It painted a picture of prosperity for social media users. But professionals spotted the red flags.

Financial advisor Sushma Bandelkar said, “Investors should reason whether promised (high) returns are feasible or not. Instead of chasing such unreasonable profits, they should put their money in a safe and practical investment.”

Ashit Sheth, a financial consultant from Fort, said, “No financial planner will advise you to put your hard earned money in a scheme which offers returns that are too good to be true. Sadly, the human mind falls for get-rich-quick schemes. I doubt any of Torres’s investors consulted a CA or investment planner. The expert would have advised them to heed the warnings.”

“Laalach buri balaa hai (Greed comes at a cost). We have seen the case of PMC Bank which went bust after giving high returns for a time. It soon became unsustainable and collapsed, and then thousands of common depositors lost their life savings,” said Sardar Swaran Singh of Andheri East where thousands of retirees fell victim to PMC’s closure.

Even now, Torres promises a revival. Weekly returns of 7-10% are promised throughout Jan. The company has posted videos blaming a handful of employees for “instigating people and looting the stores at night”. It has turned off comments on its posts, though.